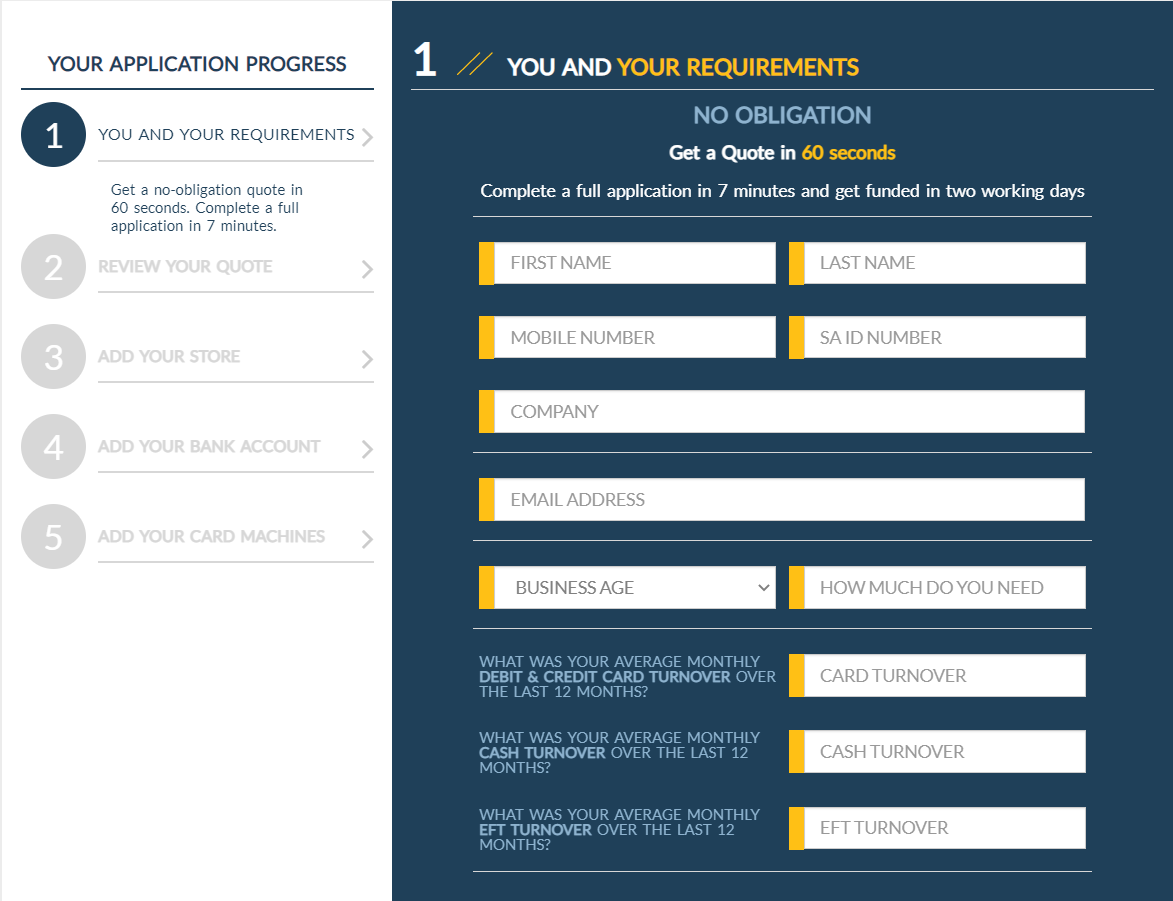

Applying for a Merchant Cash Advance can take no more than a few minutes if you have all your documentation on hand.

Our Cash Advance product offers a working capital solution that is much faster than traditional channels, giving you access to funding in just 24 hours. We require less documentation, give flexible terms and ensure a tailored payment plan in line with your business’s turnover. The cash advance is unsecured, meaning that no pledging of assets is needed and no offering of an equity stake is required either. This adds up to lots of wins for a business owner that needs to retain control over all its dealings.

We understand that your time is valuable and your priority is the day-to-day running of your business, so let’s break down the two quick and simple ways to apply for a Merchant Capital Cash Advance.

There are 2 easy ways to apply:

- Online: A great option if you keep unusual hours or if you prefer to apply when it’s most convenient. Once done, you will immediately receive an email guiding you on the next steps. It will also advise you on any outstanding documentation. Just a few hours later, you can expect a call from a Merchant Capital sales consultant to let you know the progress of your application.

2. Face-to-Face / Over the phone: Otherwise, you might prefer to discuss things in person, in which case we also offer the option of applying directly with a sales consultant. Our team is well equipped with all the expertise needed to guide you through the process. To get in touch with one of our sales consultants, email us on info@merchantcapital.co.za or call us on 011 217 2880.

What you need to know before applying:

Do you meet the qualifying criteria?

In order to qualify for a Merchant Cash Advance your business needs to have been in operation for more than 12 months, at least one director needs to be a South African citizen, have a valid lease agreement in place, and make an average monthly card turnover of R80 000.

What happens after you submit your application?

Following your application, we will run a personal and business credit check, process your documentation as well as contact any references provided to better understand your business’ circumstances.

What do you need for a Merchant Cash Advance?

Our online application platform has been built to allow you to upload all of your information and documentation in one place, making it simple for you to apply in your own time. At any point in the application process, you will be able to email yourself a link to return to where you left off so you don’t need to complete it all in one go.

Remember that if you need help along the way you can call us on 011 217 2880.

Most of the information you would know off hand but to be prepared here is a list of the documentation you will need:

- Lease agreement / proof of property ownership

- Bank Statements

- Merchant Statements

- Contact information for two suppliers

Personalised service

Even though you are applying online, you will always get a call from one of our sales consultants, making sure that you receive the personalized service that we pride ourselves on.

Keeping your data safe

Any information that you submit to Merchant Capital is kept private and confidential on our internal system. The minimum information is used when running a credit check Merchant Capital does NOT share or sell data with third parties.

To start your online application click below